You May Also Like

HAWAII CPA EXAM & LICENSE REQUIREMENTS 2024

Every state has unique requirements for the license, so keep reading to learn how to become a CPA in Hawaii.

The decision to become an accountant can be an important one. There are many different jobs available for those with an accountancy degree, from auditor to forensics to working with information systems. Everyone needs an accountant, including major corporations, mom-and-pop businesses and even individuals who wish to maintain and grow wealth. For that reason, there is a growing demand for accountants. That demand will increase if you attain your state-sanctioned Certified Public Accountant license, as that designation is one of the most difficult to achieve and highly regarded as well. Every state has unique requirements for the license, so keep reading to learn how to become a CPA in Hawaii.

General Requirements

Hawaii requires that all applicants for CPA licensure be citizens of the United States, U.S. nationals, or certified to work in the country. You must also have a Social Security number and be at least 18 years old. If you do not have a SSN, but desire to work in the state, consult with the board to determine if another form of taxpayer ID will suffice. You will need to have a bachelor’s degree to sit for the CPA exam, 120 semester hours, and then complete a total 150 semester hours to achieve the license. There is no requirement for an Ethics exam in the Aloha State, but you will need to fulfill its experience requirements prior to licensure. If you don’t have a need for the full license, Hawaii is a two-tiered state and has an allowance for those who only need a certificate.

Education Requirements

To satisfactorily complete the state’s education requirements, you will need to ensure that your coursework follows certain policies. For instance, you will need 24 hours’ worth of accounting courses. Only six of those hours can be introductory level courses, the remaining 18 hours must be upper-level or graduate-level courses. Consult with your academic advisor to learn exactly which courses you’ll need. You will also need 24 hours of upper-level or graduate courses in business. For your accountancy coursework, you might take courses such as these:

- Taxation

- Audits

- Attestation

- Financial Reporting

- Cost Accounting

- Corporate Finance

- Accounting Information Systems

- Accounting Theory

- Forensic Accounting

- Financial Planning

- Trusts and Estates

Your business classes allow you to round off your learning with less technical concepts and skills. Consider courses such as the following:

- Business Communications

- Business Law

- Marketing

- Management

- Economics—Macro and Micro

- Statistics

- Legal Aspects of Business

Once you have achieved 120 semester hours (or the quarter system equivalent) and have a bachelor’s degree in accounting, you can apply to sit for the Uniform CPA Exam. This is a 4-part test created by the American Institute of Certified Public Accountants (AICPA.) The AICPA’s test is considered one of the most difficult professional examinations in the nation and it is imperative to prepare diligently. The four portions of the test are:

- Financial Accounting and Reporting (FAR)—Items test knowledge of the financial reporting frameworks from several industry experts. You will be asked to compare statements that reflect different reporting standards.

- Auditing and Attestation (AUD)—A test of your knowledge of the International Standards of Auditing as well as U.S. standards.

- Regulation (REG) —our professional and legal duties are covered in this test.

- Business Environment and Concepts (BEC) —This portion covers general business concepts and international business. Written communication skills are vital to complete much of the test.

You might consider taking a CPA preparation course. Commercial courses will not count towards your education requirements for licensure, but you might find an accredited college or university that offers credited coursework that will sharpen your skills and knowledge, while also furthering your application for a license in Hawaii.

Experience Requirements

Hawaii is quite specific in its requirements and you’ll need to complete 1,500 hours in auditing for a public accounting practice. You must provide certification of this experience by submitting a Certification of Public Accountancy Experience form, signed by your CPA-licensed supervisor.

Alternately, you might practice for two years, working a minimum 35 hours per week in a public, governmental or private accountancy. You may also teach at the university level to complete the requirements. If you teach, you will need to teach upper-level accounting courses. Business courses and intro-level courses are unlikely to satisfy the Board.

Ethics Requirement

Most states require a standardized Ethics Exam from the AICPA. Hawaii, however, only requires that you take four hours of continuing professional education in ethics. You might inquire to see if the AICPA self-study course and exam will satisfy the requirements. If you pass the AICPA test in Hawaii, you might have an easier time transferring your license in the future.

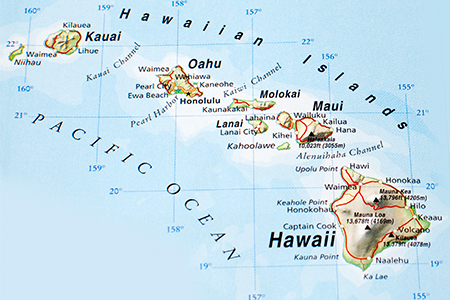

Accountancy in Hawaii

Though Hawaii is a small and less-populated state, it does have a significant concentration of accountancy activity. Each of the Big Four accounting firms has a branch in Honolulu. There are also plenty of other financial services firms on the islands that offer individual investing advice and services, as well as consultancy for large and smaller businesses. After Honolulu, Hilo, on the Big Island, is the other hub of financial activity in the state. Enterprising accountants may also be able to find business on Maui or one of the smaller islands.

If you love sunshine, tropical breezes and surf, you will be happy to set up shop as a CPA in Hawaii.

For more information, please consult Hawaii’s state board. Their website can be found here: Hawaii Board of Public Accountancy.